social security tax netherlands

Tax and Customs Administration. Expats often need to know Where does that other 30 go to.

Netherlands Social Security Rate For Companies 2022 Data 2023 Forecast

National insurance schemes that are compulsory for everyone who works or lives permanently in the Netherlands.

. If your income is above 69399. When exactly depends on your tax position and. It helps many people who without the agreement would not be eligible for monthly retirement disability or survivors benefits under the social security.

Employers may provide such items tax free only if their total value is less than 15 of salary costs. To hire foreign workers with exceptional qualities specific expertise that are scarce on the Dutch labour market there is an appealing incentive. The 30 special tax rate.

As a basic rule anyone who lives and works in The Netherlands is subject to social security legislation in The Netherlands. However its not possible to be insured in both countries at the same time. You will pay 3707 on the income up to 69399 and 4950 on the income in the excess of 69399.

The Social Security Rate in Netherlands stands at 5124 percent. SOCIAL SECURITY TAX TREATY link to text According to this agreement you are either insured for social security in the Netherlands or in the United States. Employers or entities that pays the wages withholds the wage withholding tax and pays it periodically to the Dutch Tax Administration.

Who Pays Social Security Tax in Netherlands Posted on 19 april 2022 by studiobliksemflitsnl The total social contribution for employees is 2765 which is divided into different types of benefits 179 social security for old age 01 dependentspouse and 965 for long-term care. In principle every Dutch tax resident is liable to pay social security contributions on their earned income. In the Netherlands the average amount of take-home-pay from gross salary is only 70.

Netherlands Non-Residents Income Tax Tables in 2022. Salary social security and payroll tax for the Netherlands. Income Tax Rates and Thresholds Annual Tax Rate.

Advice regarding tax and social security position. The wage withholding tax consists of one amount. The Netherlands offers a special tax rate for certain expats who have been recruited to work in the Netherlands for a specific role.

An income-related contribution 67 on income up to a maximum of EUR 59706 with a maximum of EUR 4200 to be paid to the Dutch tax authorities by the employer. Wlz Act on long-term care. When on a mobile device make sure to scroll down for complete information If you reside in The Netherlands and have questions regarding services provided by the Social Security Administration SSA you must contact the SSA Federal Benefits Unit FBU located in Dublin Ireland.

An agreement effective November 1 1990 between the United States and the Netherlands improves social security protection for people who work or have worked in both countries. What is social security contribution in the Netherlands. Briefly stated companies may if the employee complies with certain conditions pay out 30 of the salary tax free to.

The Dutch social security contribution is levied together with income tax. For more information on their. There are 2 types of social insurance schemes in the Netherlands.

Employee insurance schemes that are mandatory for every employee. In Netherlands the Social Security Rate is a tax related with labor income charged to both companies and employees. Note that when you are covered in the Netherlands you will no longer be covered by your own countrys.

Its intended to compensate the employee for the expense of their move and the cost of living in the Netherlands. As business owners and working people you know that wage and take-home pay are often very different after payroll tax. A nominal contribution of approximately EUR 1522 including EUR 385 own-risk to be paid to the health insurance company and.

You are obliged to file an income tax return in the Netherlands when you have been invited to do so by the Dutch Tax Authorities or when you expect to have to pay more than EUR 48 in income tax. If these rates are likely to put you out on the streets dont panic just yet. The work-related costs scheme allows employers to provide some benefits tax free such as travel allowances study costs lunches and Christmas hampers.

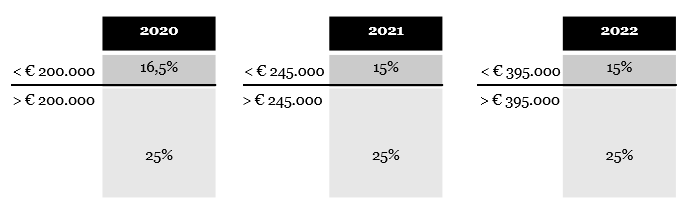

Rate Box 2 income from a substantial interest in a limited company. Resident and non-resident tax payers who earn employment income are subject to Dutch wage tax and social security premiums. The Netherlands has published in the Official Gazette the regulation from the Ministry for Social Affairs and Employment that sets the social security contribution rates for 2021.

There are allowances for ZZPers who earn below a certain level and meet certain requirements more below. The total state social security contributions are maintained at 2765 including general old-age social security AOW 1790 surviving dependent spouse social security ANW. Revenues from the Social Security Rate are an important source of income for the government of Netherlands because they help to pay for.

The Dutch tax year starts on 1 January and ends on 31 December. The contribution is 2815 percent of your salary but will never exceed about 9400 euros. AOW General Old-age Pensions Act.

ANW General Surviving Relatives Act. If their total value exceeds 15 the employer must pay 80 tax on the excess. National insurance premiums premiums social security Total premium for the national insurance is 2765 which is divided in.

The income tax return needs to be filed in the consecutive year.

Can I Contribute To Social Security From Overseas

Total Tax Revenue Us Taxes Are Low Relative To Those In Other Developed Countries In 2014 Us Taxes At A Gross Domestic Product Developing Country Social Data

Ca 14th Oct 19 Sierra Leone Curitiba Brics

Social Security In The Netherlands Zorgverzekering Informatie Centrum

Is India Good For Expats Salary Work Visa Tax Social Security

Do Expats Get Social Security Greenback Expat Tax Services

Stephen Heiner In Paris How To Normalize Your Tax Contributions In France Contribution France Tax

Social Security Benefits For Noncitizens Everycrsreport Com

/GettyImages-576720420-27eaa138a2e144d2b957315f18ef2725.jpg)

Social Security Tax Definition

Payroll Tax Netherlands Safeguard Global

Pin By Eris Discordia On Economics Worker Labour Cost Slovenia

Dutch 2021 Tax Bill And Real Estate In The Netherlands Insights Greenberg Traurig Llp

Social Security Totalization Agreements

Payroll Tax Netherlands Safeguard Global

Taxation In The Netherlands Amsterdamtips Com

How To Retire In The Netherlands As An American 2020 Aging Greatly